We’re excited to announce the release of a new “Tax Exempt” feature, giving you more control over how taxes are handled for your customers. This feature is ideal for businesses that cater to both retail and wholesale customers, or those that need to manage tax exemptions for specific customers.

What’s New?

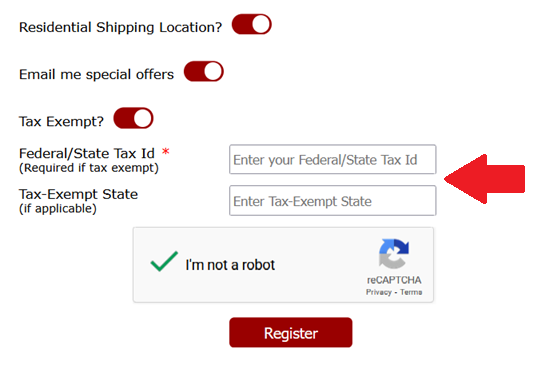

Store owners can now enable a “Tax Exempt” option on the sign-up page, allowing customers to indicate their tax-exempt status. When enabled, customers can provide their Federal or State Tax ID and the name of their tax-exempt state during registration.

Key Features:

Customer Self-Service:

Customers can manage their tax exemption details, including their Tax ID and Tax-Exempt State, through the “Modify My Account” page (modify_my_account.asp).

Merchant Control:

Merchants can also update customer tax exemption details directly from the customer edit page in the admin panel.

Easy Setup:

To enable the “Tax Exempt” option on your customer registration page, navigate to General > Login Settings and activate the “Enable Tax Exempt Choice” option. You can access this page directly using this link: https://manage.storesecured.com/dnStore/General.aspx?tab=LoginSettings

How it Works:

- When a shopper indicates they are tax exempt, the system will require them to enter their Tax ID.

- This feature is particularly useful for wholesale sites.

- For stores with a mix of retail and wholesale customers, enabling the “Tax Exempt” choice allows customers to manage their own tax status.

- If your taxes are determined by the shipping location, you can still manually mark a customer as tax exempt from the admin customer edit screen, even if the customer doesn’t select the option during signup.

- For regular retail sites without wholesale customers, we recommend calculating taxes based on the shipping location and not enabling the customer-selected tax exemption option.

Recommendations:

Wholesale Sites:

Enabling the “Tax Exempt Choice” is highly recommended.

Mixed Retail/Wholesale:

Enabling the “Tax Exempt Choice” allows customers to manage their status.

Retail Sites:

It’s generally recommended to calculate taxes based on shipping location and not enable the customer-selected tax exemption option.

Need Help?

For further assistance, please don’t hesitate to contact us at support@storesecured.com or call us at (866) 324-2764.

~ Support Team,

Store Secured, LLC